Indian Economy under previous government.

The Ten Years of UPA Rule

During the ten years of UPA rule from 2004 to 2014, India's economy underwent significant transformations. The UPA government, led by Prime Minister Manmohan Singh, presided over a period that saw dramatic changes in India's economic indicators, particularly in the area of trade balance and manufacturing.

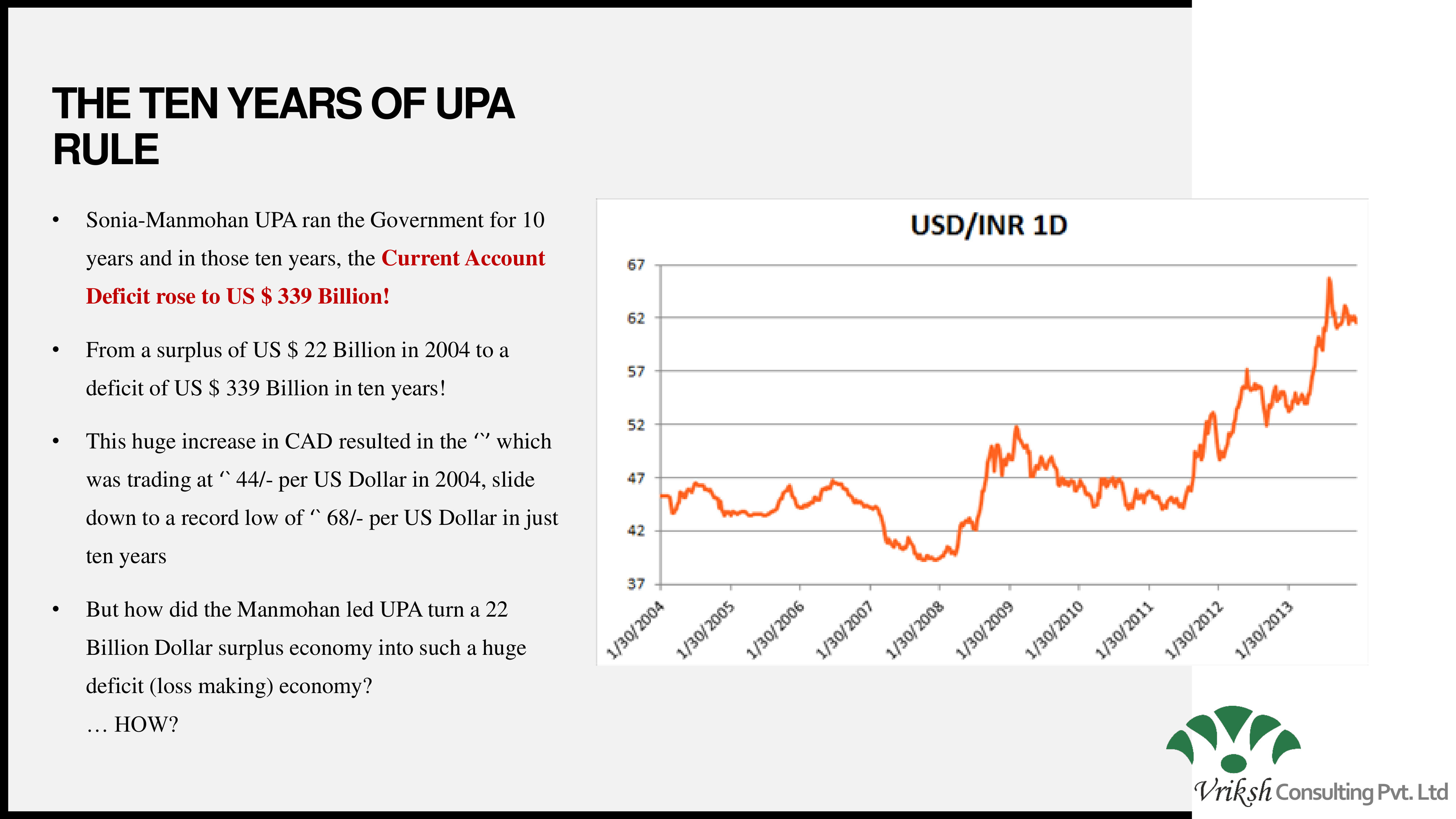

One of the most striking developments during this period was the shift in India's Current Account Deficit (CAD). From a surplus of US $22 Billion in 2004, the country moved to a deficit of US $339 Billion by the end of the UPA's tenure - a dramatic reversal in economic fortunes that had significant implications for the value of the Indian Rupee and the broader economy.

Chart showing USD/INR exchange rate from 2004-2013

Capital Goods Imports and Currency Devaluation

A key factor in this economic shift was the dramatic increase in Capital Goods imports. During the UPA's decade in power, Capital Goods imports totaled an astonishing US $587 Billion, compared to approximately US $10 Billion per year during the previous NDA government.

Comparison of capital goods imports between UPA and NDA governments

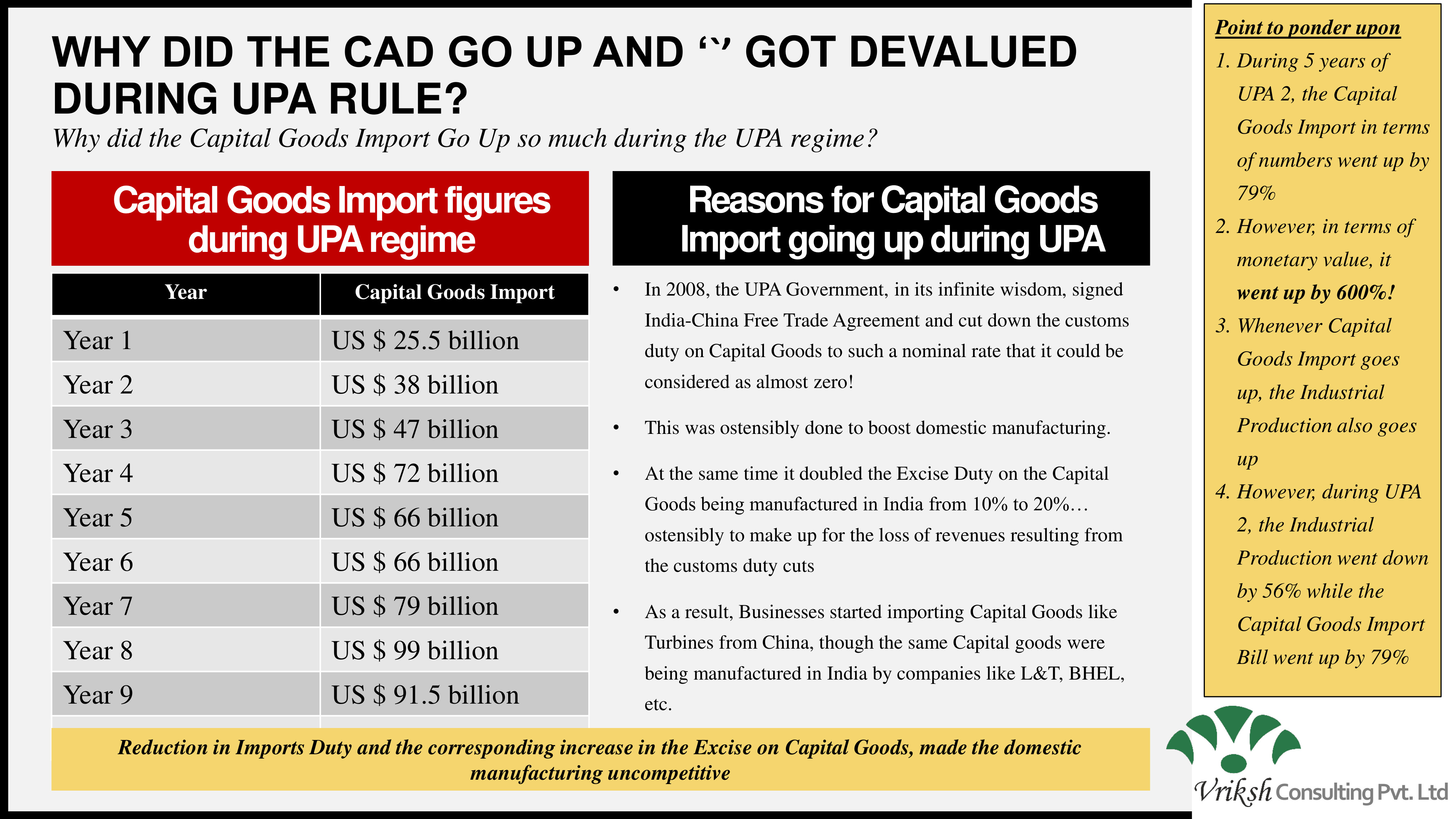

This surge in imports coincided with policy changes that had profound effects on domestic manufacturing. In 2008, the UPA government signed the India-China Free Trade Agreement, which dramatically reduced customs duties on Capital Goods imports. Simultaneously, the government increased excise duties on domestically manufactured Capital Goods from 10% to 20%.

Year-by-year capital goods import figures during the UPA regime

Impact on Domestic Manufacturing

The combined effect of these policies was devastating for India's domestic Capital Goods manufacturing sector. Indian manufacturers like L&T and BHEL became increasingly non-competitive against Chinese imports. Production of Capital Goods in India reportedly fell to approximately 1/10th of what it was in 2004.

Analysis of how policy changes affected domestic manufacturing

The consequences extended beyond the manufacturing sector. As large Capital Goods producing factories struggled and many eventually closed, unemployment rose. With rising unemployment came reduced purchasing power, contributing to economic slowdown. The manufacturing contraction, combined with increased imports, led to a steep rise in the Current Account Deficit.

Impact of capital goods imports on the Indian economy

Tax Policy Contradictions

Another aspect of economic policy during this period involved tax waivers and exemptions. In 2005, Finance Minister P. Chidambaram announced plans to eliminate tax waiver schemes and duty drawbacks, ostensibly to protect the interests of the poor. However, by 2008, tax waivers had increased dramatically from Rs 2.5 lakh crores to Rs 22.5 lakh crores.

Analysis of tax policy contradictions during the UPA government

Conclusion

The economic policies implemented during the UPA government's decade in power had far-reaching consequences for India's manufacturing sector, trade balance, and currency valuation. The dramatic increase in Capital Goods imports, coupled with policy changes that disadvantaged domestic manufacturers, contributed to a significant shift in India's economic indicators.

This case study provides valuable insights into how trade and fiscal policies can impact a nation's economic trajectory, offering important lessons for current and future economic planning.

Related Articles

Subscribe to Our Newsletter

Stay updated with our latest insights and industry trends.

Need Expert Economic Analysis?

Our team of experienced consultants can help your business navigate complex economic landscapes and make informed decisions.